Loading

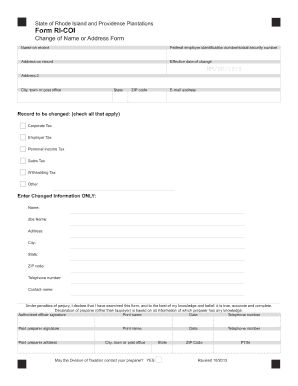

Get Change Of Name Or Address Layout 1 - State Of Rhode Island ... - Tax State Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Change Of Name Or Address Layout 1 - State Of Rhode Island online

This guide provides clear instructions on how to accurately fill out the Change Of Name Or Address Layout 1 form for the State of Rhode Island. Whether you are changing your name or your address, this user-friendly approach will help ensure your submission is correct and complete.

Follow the steps to successfully complete the form.

- To begin, locate and press the ‘Get Form’ button to access the Change Of Name Or Address Layout 1 form. This will open the document for you to begin filling it out.

- In the 'Name on record' section, enter your current official name as it appears in the records. This establishes the identity being changed.

- Next, provide your federal employer identification number or social security number in the designated field to link your records accurately.

- Fill in the 'Address on record' field with your current physical address. This must correspond to the address on file.

- Specify the 'Effective date of change' using the MM/DD/YYYY format to indicate when the change should take effect.

- Complete the 'Address 2' line if you have additional address information. Include the city, state, and ZIP code for clarity.

- In the field labeled 'E-mail address', enter your current email address to receive important communications regarding your application.

- Indicate the records that need to be changed by checking all applicable boxes, such as Corporate Tax or Sales Tax.

- In the 'Enter Changed Information ONLY' section, provide your new name, if applicable, and any updated address information, including city, state, and ZIP code.

- Under 'Authorized officer signature', sign and print your name to authenticate the submission. Additionally, include the date and your telephone number.

- If you have used a paid preparer, ensure they complete the 'Paid preparer signature' section and provide their address details.

- Finally, answer whether the Division of Taxation may contact your preparer by selecting 'YES' if you consent.

- Once all the sections are filled out accurately, you can save your changes, download a copy of the completed form, print it, or share it with relevant parties as needed.

Complete your Change Of Name Or Address Layout 1 form online today for a smooth update process.

Every part-year individual who was a resident for a period of less than 12 months is required to file a Rhode Island return if he or she is required to file a federal return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.