Loading

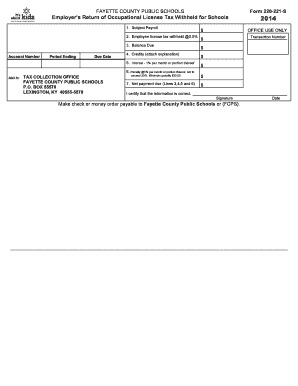

Get Form 220 221 Employer's Return Of License Fee Withheld

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 220 221 Employer's Return Of License Fee Withheld online

Filling out the Form 220 221 Employer's Return Of License Fee Withheld is essential for employers to report any occupational license tax withheld from employees' payrolls. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Subject Payroll' section, enter the total payroll amount for the period you are reporting. This figure should reflect all wages paid to employees whose license tax has been withheld.

- Next, in the 'Employee license tax withheld @0.5%' field, calculate the total amount of tax you have withheld from employees during the reporting period by applying the 0.5% rate to the subject payroll. Enter this figure.

- In the 'Balance due' section, if applicable, indicate any remaining balance that needs to be addressed based on previous filings or adjustments.

- Fill in the 'Account Number' field with your assigned identification number for accurate processing.

- Specify the 'Period Ending' date for the payroll reporting, along with the corresponding 'Due Date' for submitting the form.

- If you have any credits to report, provide details in the 'Credits' section and ensure you attach any necessary explanations for those credits.

- Calculate any interest that may apply. Use the rate of 1% per month or portion thereof to determine the total interest owed and write this amount in the designated field.

- For assessing any penalties, enter the amount in 'Penalty @5% per month or portion thereof.' Remember, the penalty cannot exceed 25%, and the minimum is $25.00.

- Total all applicable amounts to determine the 'Net payment due' by adding lines 3, 4, 5, and 6. This is the total amount you must pay.

- Before submitting, ensure that you certify the accuracy of the information by signing the form and entering the date.

- Once you have completed all the sections, you can save your changes, download, print, or share the form as required before mailing it to the Tax Collection Office.

Complete your documents online to ensure timely processing and compliance.

The initial license fee is $100 and the annual minimum license fee is also $100. Due dates: The initial license fee is due at the time of registration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.