Loading

Get Annual Report Form - Maryland Taxes - The Comptroller Of Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annual Report Form - Maryland Taxes - The Comptroller Of Maryland online

This guide provides a comprehensive approach for filling out the Annual Report Form for Maryland Taxes. Designed for ease of use, it ensures you have all the necessary information to complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to access the Annual Report Form for Maryland Taxes and open it in your preferred document editor.

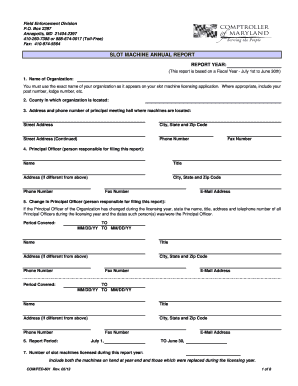

- Begin with Report Year: Enter the fiscal year for which you are reporting, which should cover a period from July 1st to June 30th.

- In the Name of Organization field: Input the exact name of your organization, as stated on your slot machine licensing application. Include any relevant identifiers such as post or lodge numbers.

- Next, provide the County in which your organization is located.

- Fill in the Address and phone number of the principal meeting hall where the slot machines are located. Include street addresses, city, state, zip code, phone number, and fax number.

- Identify the Principal Officer, the individual responsible for filing the report. Fill out their name, title, address (if different), phone number, fax number, and e-mail address.

- If there has been a Change in Principal Officer, list the details of all previous officers during the licensing year, noting their names, titles, contact information, and the periods they served.

- State the Report Period, confirming it is from July 1st to June 30th of the fiscal year in question.

- Record the Number of slot machines licensed during the report year, indicating all machines present at year-end as well as any that were replaced.

- Complete the Slot Machine Proceeds and Payout Report section. For each machine, provide the designated metrics, including coins in, coins out, jackpots, and other necessary calculations. Be sure to include specific period dates for each machine.

- Continue with any additional machines as needed, ensuring you provide complete details for each unit listed.

- Summarize the total gross play, total payouts, and net proceeds on the Summary section. Use the calculations from the previous steps to accurately fill this out.

- If applicable, declare any losses your organization experienced during the report year, detailing the circumstances of these losses.

- Describe the Use and Disposition of Proceeds that details charitable contributions made from net proceeds, ensuring to include the organization names, amounts, and purposes.

- In the Certification and Signature section, enter the Principal Officer's name, organization name, and date. Sign and confirm that the report is accurate.

- Finally, ensure the original report is submitted to the Comptroller of Maryland by the deadline, keeping a copy for your records.

Start filling out your Annual Report Form online today to ensure timely and accurate submission.

Individual Tax Forms and Instructions Download them. You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices. Visit any of our taxpayer service offices to obtain forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.