Loading

Get Acquisition Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Acquisition Form online

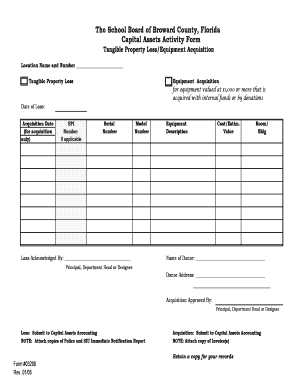

Filling out the Acquisition Form online is a straightforward process that ensures accurate reporting of equipment acquisitions and property losses. This guide will provide you with clear and step-by-step instructions for completing each section effectively.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the location name and number in the designated field.

- Select the applicable box: check 'Equipment Acquisition' if the item is acquired through a donation or internal funds, or 'Tangible Personal Property Loss' to report lost or stolen items.

- If applicable, enter the date of loss in the corresponding field.

- For acquisitions only, input the acquisition date when the item was acquired.

- Fill in the BPI number if it is assigned by Capital Assets Accounting.

- Enter the serial number of the item in the designated field.

- Provide the model number of the item for accurate identification.

- Give a brief description of the equipment in the equipment description field.

- Input the cost or estimated value of the item in the respective section.

- Specify the room or building number where the item is located.

- The loss acknowledged by section requires a signature from the Principal, Department Head, or designee where the loss occurred.

- For items received as donations, enter the name of the donor.

- Fill out the donor's address completely in the provided fields.

- Include the signature of the Principal, Department Head, or designee in the acquisition approved by section.

- Finally, save your changes, download or print the completed form, or share it as necessary.

Complete your Acquisition Form online now for efficient document management.

Report the sale of your business assets on Form 8594 and Form 4797, and attach these forms to your final tax return. Form 8594 is the Asset Acquisition Statement, which the buyer and seller must complete and submit to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.