Loading

Get Sample Defined Benefit Plan Stream-of-payment Qdro State Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Defined Benefit Plan Stream-of-Payment QDRO online

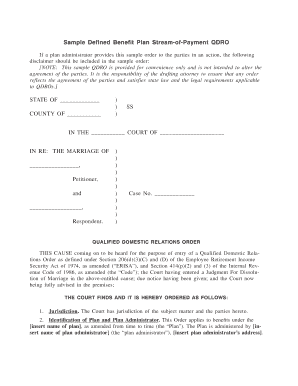

Filling out the Sample Defined Benefit Plan Stream-of-Payment Qualified Domestic Relations Order (QDRO) can seem daunting, but this guide aims to simplify the process for users of all backgrounds. Following these instructions will help ensure that the form is completed accurately and efficiently.

Follow the steps to fill out the Sample Defined Benefit Plan Stream-of-Payment QDRO.

- Click the ‘Get Form’ button to access the Sample Defined Benefit Plan Stream-of-Payment QDRO and open it in your preferred editor.

- Enter the name of the state in the designated area at the top of the document.

- Fill in the county name where the court case is being heard in the specified field.

- In the section titled 'IN RE: THE MARRIAGE OF', enter the names of the Petitioner and Respondent.

- Retrieve and input the case number in the appropriate space.

- Proceed to the 'Jurisdiction' section to affirm the court’s authority over the matter as stated.

- Identify the plan and plan administrator by inserting the name of the benefit plan and the plan administrator, including their address.

- Provide the names of the Participant and the Alternate Payee clearly in the designated fields.

- Include the last known mailing addresses and Social Security numbers for both the Participant and the Alternate Payee as required.

- Indicate the date of the court judgment regarding the dissolution of marriage and detail the state domestic relations law that applies.

- Select and specify the amount of the benefit to be assigned to the Alternate Payee, either as a percentage of monthly payments or as a fixed dollar amount.

- Outline how and when the payments are scheduled to begin and any conditions under which they may cease.

- Complete the sections regarding the potential impacts of death of the Participant or Alternate Payee.

- Ensure compliance with applicable laws, acknowledging ERISA and Internal Revenue Code requirements.

- Review the document for accuracy and completeness before submitting.

- Once satisfied with the entries, save the changes, and choose to download, print, or share the completed form.

Take action now and fill out your documents online to ensure compliance and accuracy.

Step 1 Gathering Information. ... Step 2 Drafting your QDRO. ... Step 3 Approval By the Other Party. ... Step 4 Approval by Plan as Draft. ... Step 5 Signature of QDRO by Judge of the State Divorce Court. ... Step 6 Obtain a Certified Copy of the QDRO.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.