Loading

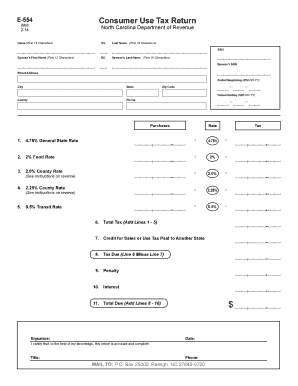

Get Form E-554 Consumer Use Tax Return - Nc Department Of Revenue - Dor State Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form E-554 Consumer Use Tax Return - NC Department Of Revenue - Dor State Nc online

Completing the Form E-554 Consumer Use Tax Return is essential for individuals and businesses in North Carolina who need to report their use tax. This guide provides a clear, step-by-step approach to accurately fill out the form online, ensuring you comply with state requirements.

Follow the steps to complete your Consumer Use Tax Return online.

- Click ‘Get Form’ button to access the form and open it for editing.

- Fill in your name, including your first name, middle initial, and last name in the designated spaces. Ensure that the information does not exceed the character limits specified.

- Enter your Social Security Number (SSN) in the appropriate field for identification purposes.

- Complete the section for your spouse, if applicable, by entering their first name, middle initial, last name, and SSN.

- Provide your street address along with the city, state, county, and zip code where you reside.

- Input your phone number so that the Department can reach you if necessary.

- Indicate the tax period by entering the beginning and ending dates in the format MM-DD-YY.

- List your purchases in the respective lines based on the applicable tax rates: general state, food, county rates, and transit rate as outlined in the instructions.

- Calculate the tax due for each line and enter it in the corresponding tax field. Add the totals from Lines 1 to 5 to get the total tax due.

- If you have paid sales or use tax to another state, enter the applicable amount in Line 7 for a potential credit.

- Subtract Line 7 from Line 6 to find the tax you owe, entering that figure in Line 8.

- If applicable, compute penalties and interest for late filing and payment according to the guidance provided.

- Calculate the total due by adding Lines 8, 9, and 10. This is the amount you will owe.

- Sign and date the form to certify that the information is accurate and complete.

- After finishing, save your changes, and choose to download, print, or share the form as required.

Complete your Form E-554 Consumer Use Tax Return online to ensure compliance with North Carolina tax regulations.

Tax Day has come and gone, but it's not too late to file your 2018 state income tax return. ... April 15 was the deadline for taxpayers who owed tax. But if you didn't get around to filing, remember that everyone gets an automatic, six-month filing extension to file until Oct. 15.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.