Loading

Get C Corp Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the C Corp Tax Return online

Filing your C Corp Tax Return online can seem challenging, but with a clear understanding of the form and its components, you can navigate the process efficiently. This guide provides step-by-step instructions to assist you in completing the return accurately and confidently.

Follow the steps to complete your C Corp Tax Return online.

- Use the ‘Get Form’ button to obtain the C Corp Tax Return form and open it in your preferred editor.

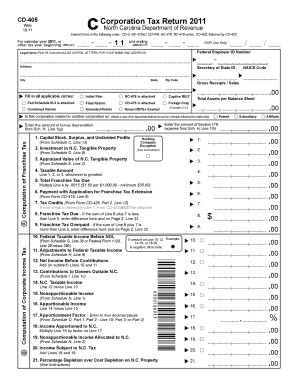

- Begin by filling out the legal name of your corporation in capital letters, along with the Federal Employer ID Number and address. This information is crucial for proper identification.

- Indicate the tax year for which you are filing, either for the calendar year or specify another tax year’s start and end dates.

- Select all applicable options, such as whether this is an initial filer, if attachments like NC-478 are included, and if this is a combined or amended return.

- Complete the computation of franchise tax, starting with the capital stock, surplus, and undivided profits from Schedule C. Follow the subsequent lines for appraised values and taxable amounts.

- Fill out the details for corporate income tax, steadily progressing through calculations including federal taxable income before NOL, adjustments, and NC taxable income.

- Review the contributions made to donees, both outside and within North Carolina, and document any amounts for deductions.

- Double-check all figures for accuracy, ensuring that your calculations line up across different sections of the form.

- After completing all sections, save any changes made to the form. You can then choose to download, print, or share the completed C Corp Tax Return as needed.

Complete your C Corp Tax Return online today to ensure timely and accurate filing.

The C corporation is the standard (or default) corporation under IRS rules. The S corporation is a corporation that has elected a special tax status with the IRS and therefore has some tax advantages. Both business structures get their names from the parts of the Internal Revenue Code that they are taxed under.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.