Loading

Get Form As 6042 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AS 6042 1 online

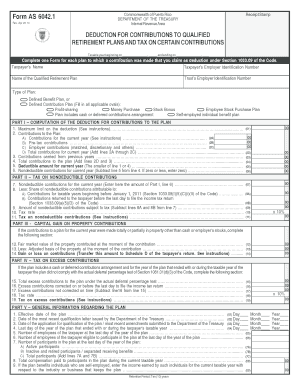

Filling out the Form AS 6042 1 can be straightforward when you have the right guidance. This form is essential for claiming deductions for contributions to qualified retirement plans, and understanding its components is key to accurate completion.

Follow the steps to complete the Form AS 6042 1 effectively.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- At the top of the form, provide your name and employer identification number, along with the name of the qualified retirement plan and its trust’s employer identification number.

- Indicate the type of retirement plan by selecting one or more applicable ovals such as 'Defined Benefit Plan' or 'Defined Contribution Plan'.

- In Part I, start by entering the maximum limit on the deduction based on the type of plan you chose. Refer to the provided sections of the Code for these values.

- Detail your contributions to the plan for the current year in Lines 2A through 2C, including contributions for the current year, pre-tax contributions, and employer contributions.

- Calculate the total contributions for the current year in Line 2D by summing lines 2A through 2C.

- Enter contributions carried from previous years in Line 3 and calculate total contributions to the plan in Line 4 by adding Lines 2D and 3.

- Determine the deductible amount for the current year in Line 5, which is the lesser of the limit in Line 1 or total contributions in Line 4.

- In Part II, move to Line 7 and enter the nondeductible contributions for the current year derived from Line 6.

- Proceed to calculate any tax on nondeductible contributions as specified in Lines 8 through 11.

- If any contributions to the plan were made in property, complete the relevant sections in Part III, detailing fair market value and adjusted basis.

- In Part IV, if applicable, provide information related to excess contributions and calculate the associated tax.

- Complete Part V with general information regarding your retirement plan as required, including effective dates and participation details.

- Once you have filled out the form, remember to save changes, and you can then download, print, or share the document as needed.

Complete your documents online to ensure a smooth filing process.

The 401(k) plan contributions you elect to make come directly out of your salary. Since the contributions are made with pre-tax dollars, your employer does not include these amounts in your taxable income for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.