Loading

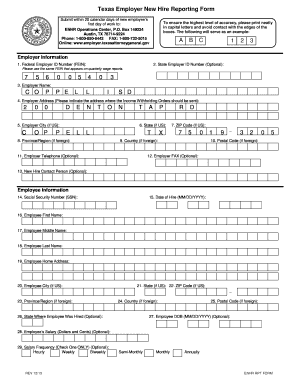

Get Texas Employer New Hire Reporting Form A B C 1 2 3 7 5 6 0 0 5 4 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Employer New Hire Reporting Form A B C 1 2 3 7 5 6 0 0 5 4 online

Filling out the Texas Employer New Hire Reporting Form is essential for compliance with the state's employment regulations. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete the form easily and accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital format.

- In the employer information section, start by entering the Federal Employer ID Number (FEIN), which is a nine-digit number assigned by the federal government. Ensure that this matches the number on your quarterly wage reports.

- Move on to the employee information section. First, input the employee's Social Security Number (SSN) and Date of Hire, ensuring to format the date correctly (MM/DD/YYYY).

- Review all entered information for accuracy to ensure compliance with the reporting requirements. Fields marked with asterisks are mandatory.

Begin filling out the Texas Employer New Hire Reporting Form online today!

Each awarded unemployment claim can affect three years of UI tax rates. Employers often don't realize the real cost of a claim since it's spread out over a long period. The average claim can increase an employer's state tax premium $4,000 to $7,000 over the course of three years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.