Loading

Get Form Fc-trs Declaration Regarding Transfer Of Shares ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FC-TRS Declaration Regarding Transfer Of Shares online

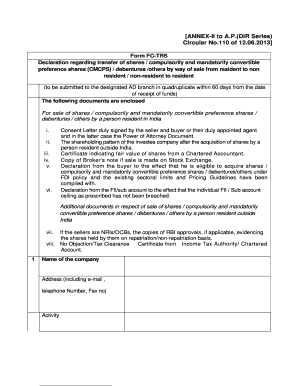

Filling out the Form FC-TRS Declaration Regarding Transfer Of Shares is a crucial step in documenting the transfer process of shares between residents and non-residents. This guide will walk you through each component of the form to ensure a smooth and efficient online completion.

Follow the steps to complete the form accurately online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by providing the name of the company involved in the transaction. Include the full address, email, telephone number, and fax number to ensure accurate contact details.

- Indicate the activity of the company and their NIC code number. This helps categorize the type of business you are dealing with.

- Specify whether Foreign Direct Investment (FDI) is allowed under the automatic route and the sectoral cap under the FDI policy, then detail the nature of the transaction (indicate if it is a transfer from resident to non-resident or vice versa).

- Fill in the names and details of both the buyer and seller, including their constitution/nature and contact information.

- Include particulars regarding any earlier Reserve Bank or Foreign Investment Promotion Board approvals relevant to this transaction.

- Provide detailed information about the shares or other instruments being transferred, including the date of transaction, number of shares, face value, negotiated price, and total consideration amount in INR.

- Document the foreign investments in the company. Note the number of shares held before and after the transfer.

- If applicable, provide valuation details according to quoted prices on stock exchanges or as determined by a Chartered Accountant.

- Complete the declaration by affirming that all information provided is accurate. This should be signed by the appropriate party, as specified in the instructions.

- Once all sections are completed, review the entire form for accuracy. Save the changes, then choose to download, print, or share the completed form as necessary.

Complete your Form FC-TRS Declaration Regarding Transfer Of Shares online to ensure a seamless transfer process.

FC-GPR is to filed when shares are issued to a non-resident whereas FC-TRS is filed when existing shares are transferred to a non-resident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.