Loading

Get Adp Fsdd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Adp Fsdd online

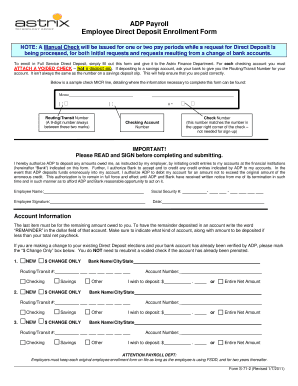

Filling out the ADP Full Service Direct Deposit Enrollment Form (Fsdd) online is a straightforward process that allows for efficient management of your direct deposit preferences. This guide provides clear and supportive instructions to ensure successful completion of the form.

Follow the steps to successfully complete your direct deposit enrollment.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information. Fill in your employee name and Social Security number in the designated fields to ensure the information is associated with your record.

- Review the authorization statement carefully. This section gives ADP permission to process deposits into the specified accounts. Make sure to read it thoroughly before proceeding.

- Indicate your account information. For each bank account where you want funds deposited, specify the bank name, routing/transit number, and your account number. Remember to indicate whether it is a checking or savings account.

- If you want to deposit the remainder of your paycheck into an account, write the word 'REMAINDER' in the dollar field of that account. Specify the amount you wish to deposit if it is less than your total net paycheck.

- If making changes to an existing direct deposit, mark the 'Change Only' box; there is no need to attach a new voided check if your bank account has already been verified by ADP.

- Finally, review all entered information for accuracy. After confirming the information is correct, proceed to sign and date the form at the required section.

- Save any changes made to the document, then download, print, or share the form as needed before submitting it to the finance department.

Start completing the ADP Fsdd online today to manage your direct deposit efficiently.

Yes. The national NACHA (The Electronic Payments Association) guidelines say that an employer is permitted to reverse a direct deposit within five business days. ... Once five business days pass, the employer is no longer allowed to reverse the direct deposit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.