Loading

Get This Information Is Also Used To Calculate The Amount Of The Fringe Benefit To Be Included In The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Information Is Also Used To Calculate The Amount Of The Fringe Benefit To Be Included In The online

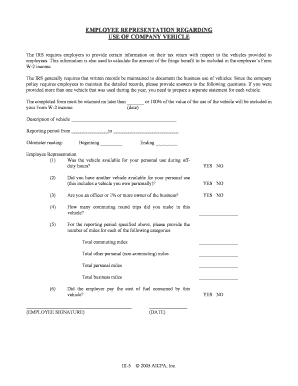

Filling out the form regarding the use of a company vehicle is an important process for accurately reporting fringe benefits. This guide will provide you with detailed steps to ensure you complete the form correctly and efficiently.

Follow the steps to accurately complete the form.

- Click the ‘Get Form’ button to access the form and open it in your chosen platform.

- Begin by providing the description of the vehicle you used during the reporting period in the designated field.

- Fill in the reporting period for the vehicle use, including the beginning and ending odometer readings.

- Answer the employee representation questions concerning the vehicle's availability for personal use, alternative vehicle availability, and ownership status.

- Record the number of commuting round trips made in the vehicle during the reporting period.

- Complete the mileage categories for the specified period, detailing total commuting miles, total other personal miles, total personal miles, and total business miles.

- Finally, indicate if the employer covered the cost of fuel consumed by this vehicle by selecting 'YES' or 'NO'.

- Sign and date the form at the bottom to confirm the provided information is truthful and complete.

- After completing the form, save any changes, and consider downloading, printing, or sharing the form as required.

Complete the form online to ensure accurate reporting of your vehicle use and fringe benefits.

Common fringe benefits are basic items often included in hiring packages. These include health insurance, life insurance, tuition assistance, childcare reimbursement, cafeteria subsidies, below-market loans, employee discounts, employee stock options, and personal use of a company-owned vehicle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.