Loading

Get Form Np 20a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Np 20a online

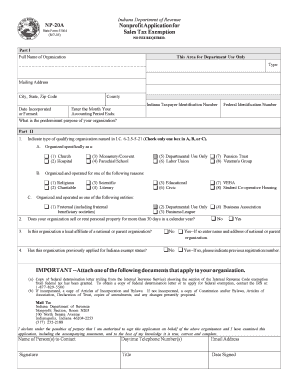

Filling out the Form Np 20a is an essential step for organizations seeking a sales tax exemption in Indiana. This guide provides clear, step-by-step instructions to facilitate the online completion of the form, ensuring a smooth filing process.

Follow the steps to successfully fill out the Form Np 20a online:

- Click ‘Get Form’ button to obtain the form and open it for online editing.

- Begin with Part I by entering the full name of your organization in the designated field.

- Complete the mailing address, ensuring to include the city, state, and zip code.

- Provide the date your organization was incorporated or formed, and indicate the county.

- Enter your Indiana taxpayer identification number and the month your accounting period ends.

- Fill in the federal identification number.

- In the next section, describe the predominant purpose of your organization clearly.

- Check only one box in Part II to indicate the type of qualifying organization as described in the Indiana Code.

- If applicable, answer whether your organization sells or rents personal property for more than 30 days in a calendar year.

- Indicate if your organization is a local affiliate of a national or parent organization and provide the relevant details.

- Specify if your organization has previously applied for Indiana exempt status and provide the registration number if applicable.

- Attach the required documents, ensuring that you include the appropriate determination letters or bylaws as specified.

- Finalize your application by providing your contact information, including name, daytime telephone number, email address, signature, title, and date signed.

- Once completed, review the form for accuracy and save any changes. You may choose to download, print, or share the form.

Complete your Form Np 20a online to ensure your organization's sales tax exemption application is submitted efficiently.

A nonprofit organization must register for a sales tax exemption by filing Form NP-20A, which can be filed using the department's online e-services portal, called the Indiana Taxpayer Information Management Engine (INTIME), by visiting intime.dor.in.gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.