Loading

Get Payflex Close Account

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payflex Close Account online

Filling out the Payflex Close Account form is essential for managing your financial accounts effectively. This guide provides clear, step-by-step instructions to ensure you complete the process accurately and efficiently.

Follow the steps to complete the Payflex Close Account form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

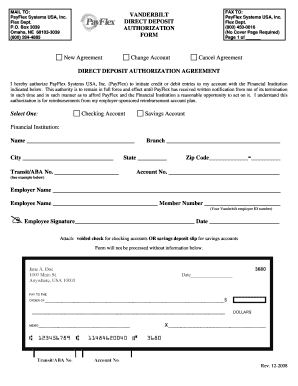

- In the first section, select whether you are creating a New Agreement, changing your account, or canceling your agreement. Ensure the correct option is selected to reflect your intent.

- Fill in the Direct Deposit Authorization Agreement section. Authorize PayFlex to initiate credit or debit entries to your account by providing the necessary details about your financial institution.

- Specify which type of account you have by choosing either a Checking Account or Savings Account. Make sure to check the correct box.

- Provide the full name of your Financial Institution, along with the city, transit/ABA number, branch name, state, and zip code.

- Enter your Account Number as indicated, following the format provided in the example below this field.

- Complete the employer-related information by entering your Employer Name, your Employee Name, and your Member Number, which is your Vanderbilt employee ID number.

- Finally, sign and date the form at the bottom. Remember to attach a voided check for checking accounts or a savings deposit slip for savings accounts, as the form will not be processed without this information.

- After completing the form, review all entries for accuracy. You can save changes, download, or print the completed form for your records.

Complete your Payflex Close Account form online today for efficient management of your accounts.

Yes, you can withdraw funds from your HSA at any time. But please keep in mind that if you use your HSA funds for any reason other than to pay for a qualified medical expense, those funds will be taxed as ordinary income, and the IRS will impose a 20% penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.