Loading

Get Aetna Retiree Reimbursement Account Form - Chevron Phillips ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aetna Retiree Reimbursement Account Form - Chevron Phillips online

This guide provides step-by-step instructions for completing the Aetna Retiree Reimbursement Account Form specifically for Chevron Phillips. Users will find clear and concise guidance to ensure a smooth filling process.

Follow the steps to correctly complete your reimbursement form.

- Press the ‘Get Form’ button to access and open the Aetna Retiree Reimbursement Account Form - Chevron Phillips in your document editor.

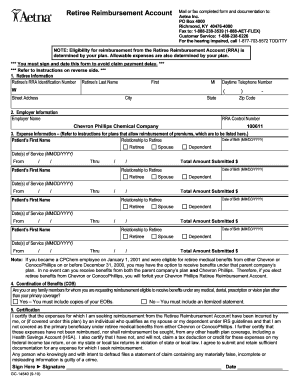

- In section 1, complete the retiree information. Include your RRA identification number, last name, first name, middle initial, daytime telephone number, street address, city, state, and zip code.

- In section 2, provide the employer information. Indicate the name of your employer (Chevron Phillips Chemical Company) and the RRA control number (100611) if it is not pre-printed.

- In section 3, fill out the expense information. List any expenses incurred with dates of service as well as details regarding each patient, including their relationship to the retiree. Specify the total amount submitted for each expense.

- In section 4, answer the Coordination of Benefits (COB) question regarding eligibility for other medical coverages. Indicate 'Yes' or 'No' and prepare any required documentation.

- In section 5, certify the information by signing and dating the form. It is essential to avoid claim payment delays.

- After completing all the sections, save your changes. You can then download, print, or share the form as needed.

Get started on completing your documents online today!

A Retiree Reimbursement Arrangement (RRA) is a way for employers to help their retirees offset healthcare costs in retirement with tax free dollars.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.