Loading

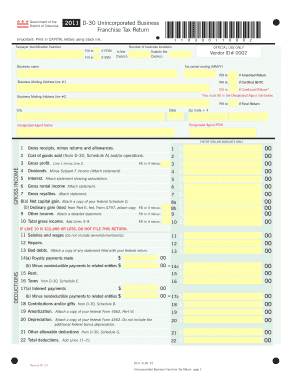

Get D-30 2011 Unincorporated Business Franchise Tax Return Fill ... - Otr - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the D-30 2011 Unincorporated Business Franchise Tax Return online

This guide provides clear and detailed instructions for filling out the D-30 2011 Unincorporated Business Franchise Tax Return online. Follow these steps to ensure accurate and timely submission of your tax return.

Follow the steps to fill out the D-30 form accurately.

- Click ‘Get Form’ button to obtain the D-30 form and open it in an online editor.

- Complete the taxpayer identification number section by entering either the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) applicable to your business.

- Fill in the number of business locations both in and outside the District of Columbia.

- Enter the gross income amounts in the provided lines. Include gross receipts while deducting returns and allowances.

- List deductions in the respective sections, ensuring to include salaries and wages, repairs, and any other allowable deductions.

- Complete the taxable income calculation by subtracting total deductions from gross income.

- If your net income is subject to apportionment, follow the instructions on the apportionment factors using Schedule F to determine the portion allocated to DC.

- Detail any payments and refundable credits, adding them up to calculate the tax due or refund amount.

- Finally, review your entries for accuracy, sign the return where indicated, and prepare to submit either electronically or via mail.

Complete your D-30 2011 Unincorporated Business Franchise Tax Return online today for a smooth filing experience.

To remit payment, please log in to your MyTax.DC.gov account, which allows you to pay directly from your bank account without any fees. To remit payment, please log in to your MyTax.DC.gov account. You will be charged a fee that is paid directly to the District's credit card service provider.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.