Loading

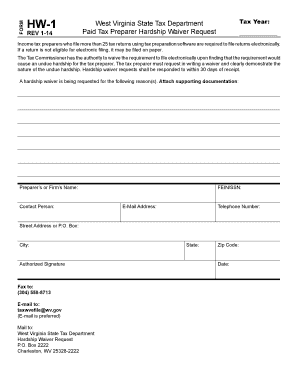

Get Form Hw-1 West Virginia State Tax Department Tax Year ... - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM HW-1 West Virginia State Tax Department Tax Year ... - State Wv online

The FORM HW-1 is used to request a hardship waiver from electronic filing for tax preparers in West Virginia. This guide aims to provide a clear, step-by-step approach to filling out the form online, ensuring users can easily complete their request.

Follow the steps to successfully complete the FORM HW-1 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the preparer’s or firm’s name at the top of the form. This identifies the entity requesting the waiver.

- Fill in the contact person's name. This should be someone who can be reached for follow-up questions regarding the waiver request.

- Provide the FEIN (Federal Employer Identification Number) or SSN (Social Security Number) associated with the tax preparer or firm.

- Enter the e-mail address. This is crucial for communication regarding the waiver request and possible responses.

- Include the telephone number for any necessary verbal follow-up from the tax department.

- Fill in the street address or P.O. Box for the preparer. Include the city, state, and zip code to ensure accurate delivery of communications.

- Affix the authorized signature to verify the request. This person must be someone who can validate the submission.

- Specify the reason(s) for the hardship waiver request directly on the form. It’s essential to explain how electronic filing would cause undue hardship and to attach any supporting documentation.

- Review your entries for accuracy and completeness before submitting the waiver request.

- Finalize your submission by either saving changes, downloading, printing, or sharing the completed form as required.

Complete your hardship waiver request and access other relevant documents online today.

You can use the Pay Personal Income Tax link on the MyTaxes Website. website to begin remitting payments electronically using the ACH Debit method. Credit Cards All major credit cards accepted. You can visit the Credit Card Payments page for more information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.