Loading

Get 2013 Form 990 (schedule F) - 990resourcecenter.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Form 990 (Schedule F) online

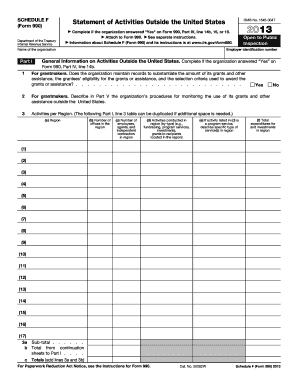

Filling out the 2013 Form 990 (Schedule F) is essential for organizations that have conducted activities outside the United States. This guide provides a structured approach to completing this form accurately and effectively online.

Follow the steps to successfully complete the Form 990 (Schedule F)

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Provide your organization's information. Fill in the employer identification number and the name of the organization at the top section of the form.

- Complete Part I by answering the question about whether the organization maintains records to substantiate grant amounts and selection criteria used. Provide a description of procedures for monitoring the use of grants in Part V.

- Proceed to list activities by region by filling in the table in Part I, indicating the region, the number of offices, employees or contractors, types of activities conducted, specific program services if applicable, and total expenditures.

- If applicable, proceed to Part II to list grants and assistance provided to organizations outside the U.S. Ensure to report each organization receiving more than $5,000 separately and provide the required details.

- If needed, complete Part III for assistance provided to individuals outside the U.S. Follow the same approach as in Part II, noting the type of assistance, region, number of recipients, and monetary details.

- Complete Part IV, responding to questions regarding engagement with foreign entities. If any 'Yes' answers are given, refer to the respective forms to determine if they need to be filed.

- Use Part V to provide any additional narrative information required to support your entries, detailing the methods of accounting for grants and expenditures, if necessary.

- After filling out all relevant sections, review the information for accuracy. Save your changes, download your completed form, print it, or share it as necessary.

Start filling out your 2013 Form 990 (Schedule F) online today to ensure a smooth and compliant filing process.

The information regarding the forgiven PPP loans must be reported on Form 990, 990-EZ, and 990-PF. Amounts of PPP loans that are forgiven must be reported on Form 990, Part VIII, Line 1e (Government grants (contributions)) as contributions from a governmental unit in the tax year that the amounts are forgiven.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.