Loading

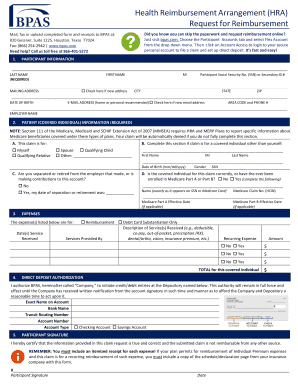

Get When Completed, Mail, Fax Or Upload This Form And Receipts To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the When Completed, Mail, Fax Or Upload This Form And Receipts To online

This guide provides a step-by-step approach to completing the When Completed, Mail, Fax Or Upload This Form And Receipts To for requesting reimbursement efficiently. Our goal is to ensure you understand each section of the form and the necessary information you need to provide.

Follow the steps to complete the form accurately and submit it online

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin with the participant information section. Fill in your last name, first name, middle initial (if applicable), and your Social Security Number or Secondary ID. Also, provide your mailing address and indicate if it is a new address. Add your city, state, ZIP code, date of birth, email address, and phone number.

- In the patient information section, specify if the claim is for yourself or another qualified individual such as a spouse or a qualifying child. If claiming for another individual, provide their first name, middle initial, last name, and date of birth.

- Indicate whether you are separated or retired from your employer and provide the date of separation if applicable. Confirm the enrollment status of the covered individual in Medicare.

- List the services that are being claimed for reimbursement. Provide the date or dates the services were received, a description of the services, and indicate whether it is a recurring expense. Enter the amount for each expense.

- If you wish to set up direct deposit for your reimbursement, fill out the direct deposit authorization section with your bank account details, including the bank name, transit routing number, account number, and the type of account.

- Review the form for accuracy. Sign and date the form in the participant signature section, certifying that the information is true and correct. Remember to include an itemized receipt for each expense.

- Save any changes you made, and prepare to mail, fax, or upload the completed form along with the necessary receipts to the designated address or fax number provided in the document.

Complete your reimbursement request online today for a quicker, hassle-free experience!

Log in to the FSAFEDS app using the same username and password as your online account. Select whether to submit a claim or pay a provider. Follow the prompts to enter claims details. Take photos of your itemized receipts (and other documentation if needed) or upload from your mobile device.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.