Loading

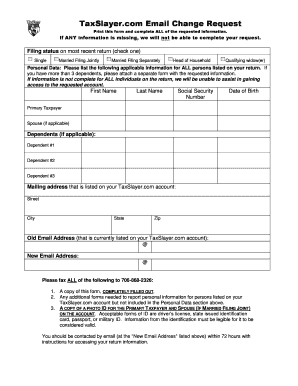

Get Filing Status On Most Recent Return (check One) - Taxslayer.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Filing Status On Most Recent Return (check One) - TaxSlayer.com online

This guide provides a clear, step-by-step approach for users to correctly fill out the Filing Status On Most Recent Return. By following these instructions, you can ensure that your filing status is accurately reported, facilitating a smooth process in updating your tax information.

Follow the steps to accurately complete the filing status section.

- Click the ‘Get Form’ button to access and retrieve the form for your use.

- Review the filing status options presented on the form. These include options like Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er). Identify the status that accurately reflects your situation and check the corresponding box.

- Proceed to the personal data section and enter the necessary information for all individuals on your return. This includes the first name, last name, social security number, and date of birth of the primary taxpayer and spouse, if applicable.

- List all dependents if applicable, ensuring that if there are more than three, a separate form is attached with their details.

- Complete the mailing address section with the street, city, state, and zip code as per the address linked to your TaxSlayer.com account.

- Provide your old email address that is currently registered on your account, followed by your new email address you wish to update to.

- Before submission, review all the provided information for completeness and accuracy. Verify that all required data has been filled in.

- Once you are satisfied with the information entered, submit the form along with any additional required identification and documentation as instructed.

Start completing your tax filing forms online today to ensure your information is up to date.

There are many different reasons why your refund may have not been processed yet, but the most common include: Your tax return included errors. Your tax return is incomplete. ... According to the Protecting Americans from Tax Hikes (PATH) Act, the IRS cannot issue EITC and ACTC refunds before mid-February.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.