Loading

Get Tc675r

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc675r online

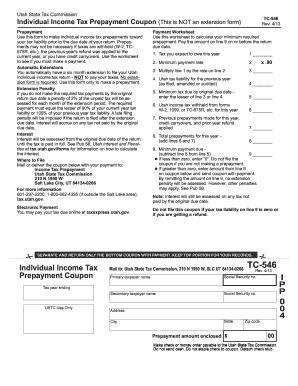

Filling out the Tc675r form is essential for managing your individual income tax prepayments in Utah. This guide provides clear instructions to help you navigate the form efficiently and accurately.

Follow the steps to complete your Tc675r form online.

- Click ‘Get Form’ button to obtain the Tc675r document and open it for filling out online.

- Begin by entering the primary taxpayer's name and Social Security number in the designated fields. If applicable, fill in the secondary taxpayer's name and Social Security number.

- Indicate the tax year ending by entering the appropriate date in the section provided.

- Complete the address section by providing your street address, city, state, and zip code.

- Calculate your expected tax liability for the current year and record this amount in the first line of the payment worksheet.

- Determine the minimum payment rate and enter this amount in the second line of the worksheet.

- Multiply the expected tax liability from step 5 by the payment rate from step 6 and write the result on line 3.

- Fill in the fourth line with your Utah tax liability from the previous year as filed, amended, or audited.

- On line 5, enter the lesser of the amounts from line 3 or line 4 to determine the minimum tax due by the original due date.

- Report any Utah income tax withheld from forms W-2, 1099, or TC-675R in line 6.

- In line 7, note any prepayments made for the current year, credit carryovers, and previous year refunds applied.

- Add the amounts from lines 6 and 7 and record the total on line 8.

- Calculate the minimum payment due by subtracting line 8 from line 5 and enter this amount on line 9. If the result is less than zero, enter '0'.

- If you have a payable amount on line 9, detach the coupon section at the bottom of the document. Send it along with your payment to the Utah State Tax Commission.

- Finally, review all the information you've entered for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your Tc675r form online today to ensure your tax prepayments are submitted on time.

Property Tax Abatement Programs: Circuit Breaker - Age & income-based, 66 years old or surviving spouse with household income up to $35,807. County Hardship Abatement - 65 years old, or any age disabled, or any age in extreme hardship, with income and adjusted assets that do not exceed $35,807.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.