Loading

Get As 22 Form Dayton

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the As 22 Form Dayton online

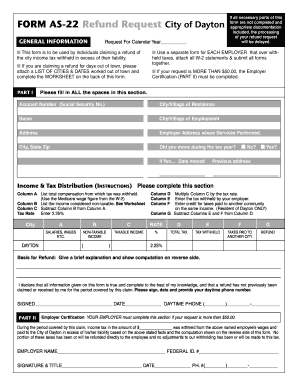

The As 22 Form Dayton is essential for individuals seeking a refund of city income tax withheld in excess of their liability. This guide provides clear and comprehensive instructions to help users complete the form accurately and efficiently, ensuring a smooth refund request process.

Follow the steps to fill out the As 22 Form Dayton online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your account number, which is your Social Security number.

- Enter your city or village of residence.

- Fill in your name in the designated field.

- Specify your city or village of employment.

- Complete your address, including city, state, and zip code.

- Indicate if you moved during the tax year and provide the date if applicable.

- If applicable, list your previous address.

- In the income and tax distribution section, complete the following: Column A with total compensation from which tax was withheld, Column B with non-taxable income, and calculate Column C by subtracting Column B from Column A.

- Enter the tax rate of 2.25% in the designated area.

- Multiply the amount in Column C by the tax rate and enter this in Column D.

- Record the amount of tax withheld by your employer in Column E.

- If applicable, enter any credit for taxes paid to another community in Column F.

- Finally, calculate the refund by subtracting the amounts in Columns E and F from Column D and enter this in Column G.

- Provide a brief explanation and show computations for the basis of your refund on the reverse side.

- Sign and date the form, and provide your daytime phone number.

- If your refund request exceeds $50.00, ensure that your employer completes the Employer Certification section.

- Once all information is filled out correctly, save your changes, and you may choose to download, print, or share the form as needed.

Complete your As 22 Form Dayton online today to ensure your refund is processed promptly.

Individuals. Click here to Log Into your 2022 Online Account. TaxAct is a provider of individual filing software for Federal and State returns. TaxAct is now making e-file available to taxpayers required to file Dayton income tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.