Loading

Get Cr 100 Colorado

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cr 100 Colorado online

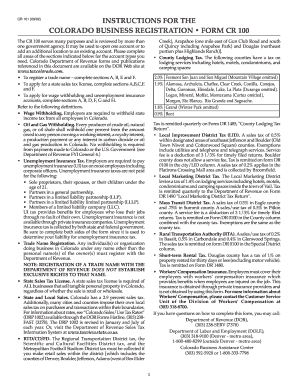

The Cr 100 Colorado form is an essential document for business registration in the state of Colorado. This guide will walk you through each section of the form to ensure that your application is completed accurately and efficiently.

Follow the steps to fill out the Cr 100 Colorado form online.

- Press the ‘Get Form’ button to acquire the Cr 100 Colorado form and open it in your desired editor.

- Begin with Section A. Indicate the reason for filing this application by selecting the appropriate box, such as original application for a new business or change of ownership for an existing one.

- In Box 2 of Section A, check the box that corresponds to the legal structure of your business, ensuring you select the correct designation.

- Move to Section B, starting with Line 1 where you will enter the taxpayer name as specified based on your business structure. Refer to the guidelines to format the name correctly.

- On Line 2a, if applicable, enter the trade name under which your business operates, ensuring it is registered with the Colorado Secretary of State.

- Complete Line 3a with the street address of your principal place of business, avoiding the use of a post office box.

- If necessary, provide a mailing address in Line 4a/4b, ensuring it is distinct from the physical address.

- In Section C, identify if your business is seasonal and choose the appropriate filing frequency in Box 2 based on your sales tax collection.

- In Section D, estimate your expected wage withholding for employees annually. Understanding this will help determine future filing frequency.

- Fill out any applicable fees in Section E, including trade name registration, sales tax deposits, or licenses required for your business.

- Ensure that Section F is signed; lacking a signature means your form will not be processed.

- Review all sections for completeness and accuracy before saving changes, downloading, printing, or sharing the filled-out form.

Complete your Cr 100 Colorado form online today to ensure your business is properly registered.

To apply for this certificate with Colorado, use the Application for Sales Tax Exemption for Colorado Organization (DR 0715). No fee is required for this exemption certificate and it does not expire. All valid non-profit state exemption certificates start with the numbers 98 or 098.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.