Loading

Get Joint Business Registration Form - Intuit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JOINT BUSINESS REGISTRATION FORM - Intuit online

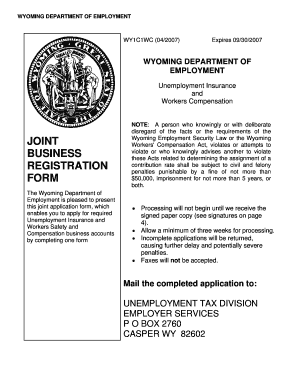

Filling out the Joint Business Registration Form is a vital step for businesses looking to establish unemployment insurance and workers compensation accounts in Wyoming. This comprehensive guide will take you through each section of the form to ensure a smooth and successful submission process.

Follow the steps to complete the registration form effectively.

- Click the ‘Get Form’ button to access the Joint Business Registration Form. This will allow you to download and open the form for completion.

- In section 1, provide the legal business name exactly as it appears on official documentation.

- In section 2, fill in the ‘Doing Business As’ field if your business operates under a different name.

- Complete section 3 by entering your business address. Include the street or P.O. Box, city, state, and zip code.

- For section 4, list all physical locations or work sites in Wyoming. Provide complete street addresses and include location types like office or job site.

- Identify the contact person for your business in section 5, alongside their business telephone number and any optional fax number.

- In section 6, select the type of business ownership by checking the appropriate box.

- Section 7 requires you to indicate the reason for applying and, if applicable, provide details about any previous business.

- Fill out sections 8 and 9 to provide information about employee hiring dates and estimated monthly payroll.

- In section 10, identify all owners or partners, including their titles, social security numbers, percentage of ownership, and state of residency.

- Enter your Federal Employer Identification Number (FEIN) in section 11. If you do not have one yet, leave the field blank.

- Section 12 asks whether your business is covered by the Federal Unemployment Tax Act—please answer accordingly.

- Provide detailed descriptions of your business activities in section 13, ensuring to complete both parts 13a and 13b.

- If applicable, answer sections 14 to 17 based on your business type, following the specific instructions provided.

- Finally, ensure that the signature section on page 4 is completed by the appropriate individual who is authorized to sign on behalf of the business.

- After completing the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Start filling out your JOINT BUSINESS REGISTRATION FORM online today to ensure timely processing.

No, you do not need a separate LLC tax filing or return. Because LLCs are registered with the states they do not require federal returns. So, unless the LLC chooses to be treated as a corporation: A single-member LLC should file Form Schedule C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.