Loading

Get Sers 254

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sers 254 online

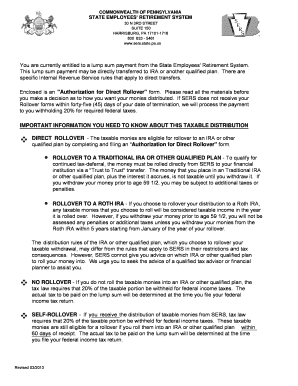

Filling out the Sers 254, or Authorization for Direct Rollover form, is an important step for individuals entitled to a lump sum payment from the State Employees' Retirement System. This guide provides clear, step-by-step instructions to ensure you complete the form correctly and efficiently.

Follow the steps to complete your Sers 254 online

- Click the ‘Get Form’ button to access the Sers 254 document and open it for editing.

- Begin by completing Part 1, known as the Member Agreement. Fill in your Social Security Number, full name, and contact telephone number. Also, provide your retirement date if applicable.

- Indicate your reason for rollover by checking the appropriate box—options include Refund, Retirement, or Installment.

- Provide your complete address including city, state, and zip code to ensure the correct processing of your form.

- Specify the amount you wish to rollover. You can choose to rollover All or a Partial amount. Fill in both taxable contributions and any pre-1987 previously taxed contributions as applicable.

- Affirm that the information you provided is accurate by signing and dating the form in the designated areas.

- Once Part 1 is complete, submit the form to your designated financial institution for them to complete Part 2.

- The financial institution must fill out their information accurately, including their name, address, and contact details. They will also need to check whether the account is a Traditional IRA or Roth IRA.

- The financial institution must sign and date the form to confirm their agreement to accept the rollover.

- After completing and obtaining all necessary signatures, save your changes and make a copy of the form for your records before submitting it to SERS.

Ensure your financial future is secure by completing the Sers 254 online today.

Any taxable eligible rollover distribution paid to you from an employer-sponsored retirement plan is subject to a mandatory income tax withholding of 20%, even if you intend to roll it over later.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.