Loading

Get Form 3949a Template.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3949A Template.pdf online

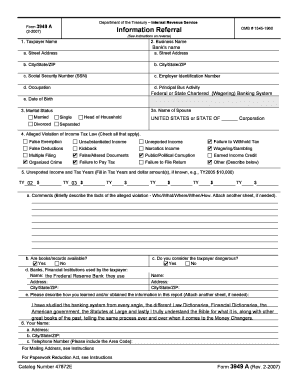

Filling out the Form 3949A Template online can be a straightforward process when guided properly. This form is an information referral used by the Internal Revenue Service to report potential violations of income tax law, and being well-prepared helps ensure accurate submission.

Follow the steps to complete the Form 3949A Template online:

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the first section, provide the name of the taxpayer and any associated business name. Include the address details such as street, city, state, and ZIP code, along with the Social Security Number or Employer Identification Number.

- Indicate the occupation of the taxpayer and provide the principal business activity. Enter the taxpayer's date of birth in the designated field.

- Select the marital status of the taxpayer by checking the appropriate box and, if married, provide the name of the spouse.

- In this section, check all relevant alleged violations of income tax law. Options include false exemption, unsubstantiated income, failure to pay tax, etc. Ensure all applicable checkboxes are marked.

- If your report involves unreported income, fill in the relevant tax years and dollar amounts associated with each year.

- Provide comments that briefly describe the facts surrounding the alleged violation, including who, what, where, when, and how. You may attach additional sheets if more space is needed.

- Indicate whether books or records are available by checking either yes or no.

- List any banks or financial institutions used by the taxpayer by entering their name and address details.

- Assess if you consider the taxpayer to be dangerous and provide details in the comments section if applicable.

- Explain how you learned of and obtained the information contained in your report, including any necessary attachments.

- Finally, enter your name, address, city, state, and ZIP code, along with a telephone number where you can be contacted. Note that this information is optional but helpful.

- Once you have filled the form, you can save your changes. Use options available in your editor to download, print, or share the completed form.

Start filling out the Form 3949A online today to ensure compliance with tax reporting requirements.

The PDF files are embedded in the return so that you can view them any time you access the return. To attach a PDF to a return for electronic filing, do the following: Review the IRS and DOL requirements for required PDF attachments. Open the return to be electronically filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.