Loading

Get Patrick Devine 98 Ein

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Patrick Devine 98 Ein online

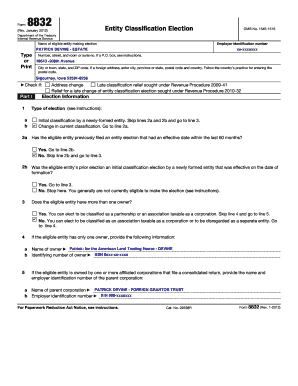

Filling out the Patrick Devine 98 Ein form online can seem daunting, but with the right guidance, it can be a straightforward process. This guide provides clear, step-by-step instructions to help you effectively complete the form for your entity classification election.

Follow the steps to ensure your form is correctly filled out.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer identification number (EIN) of the eligible entity making the election in the specified field. Ensure that it is accurate, as this number is vital for processing.

- Complete the name and address section. Provide the full name of the eligible entity making the election along with the complete address, ensuring to include the city, state, and ZIP code.

- In Part I, check the appropriate box indicating the type of election you are making: initial classification or change in current classification. Make sure to review and follow the specific instructions provided for this section.

- If the entity has previously filed an election within the last 60 months, indicated with a ‘Yes’ or ‘No’, proceed according to the instructions provided for each scenario.

- Specify the ownership structure of the entity. Indicate whether the entity has more than one owner or just one, and fill in the required information, including the owner’s name and identifying number if applicable.

- Complete the election information section regarding the type of entity. Select the correct classification for federal tax purposes based on the guidance provided in the instructions.

- Decide an effective date for the election by entering it in the designated field. Be aware of the time constraints on how early or late the election can be made.

- Fill out the contact person’s name and telephone number, ensuring that it is someone who can be reached by the IRS for further inquiries.

- Read and sign the consent statement to confirm the information is true and accurate. Ensure that you have authorization to make the election on behalf of the entity.

- If applicable, complete Part II for late election relief, explaining the reasons for not filing in a timely manner.

- Review the entire form for completeness and accuracy. Once satisfied, users can save changes, download, print, or share the form as needed.

Start filling out the Patrick Devine 98 Ein online today and ensure your entity classification is set correctly.

Related links form

An employer identification number (EIN) is a nine-digit number assigned by the IRS. It's used to identify the tax accounts of employers and certain others who have no employees. The IRS uses the number to identify taxpayers who are required to file various business tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.