Loading

Get Imrf Tax Letter #17 Issuing Irs W-2 Forms To Imrf Members - Imrf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IMRF Tax Letter #17 Issuing IRS W-2 Forms To IMRF Members - Imrf online

This guide provides a clear and supportive overview of how to fill out the IMRF Tax Letter #17, focusing on the issuance of IRS W-2 forms for IMRF members. Whether you are filling this form online for the first time or need a refresher, you will find detailed, step-by-step instructions to assist you.

Follow the steps to successfully complete the IMRF Tax Letter #17 online.

- Press the ‘Get Form’ button to retrieve the document and open it in your online editor.

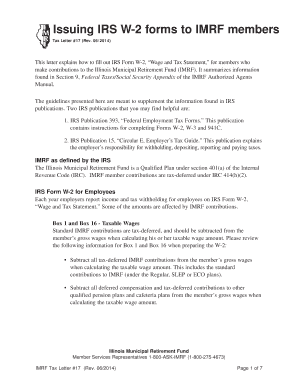

- Begin by reviewing the guidelines provided in the tax letter, especially focusing on how to calculate taxable wages, excluding tax-deferred IMRF contributions from the member’s gross wages.

- In Box 1 (Wages, Tips, Other Compensation) and Box 16 (State Wages, Tips, etc.), input the reduced taxable wage amount that accounts for standard IMRF contributions and other deferred compensations.

- For Box 3 (Social Security Wages), do not deduct IMRF contributions; ensure that any contributions to a qualified 125 cafeteria plan are subtracted instead.

- In Box 5 (Medicare Wages), enter the total wages as there is no limit for Medicare. Review to ensure accuracy compared to Box 3.

- For Box 12, remember that IMRF member contributions cannot be reported here; instead, indicate any amounts related to other plans such as 401(k) or 403(b).

- Tick Box 13 if the employee is participating in a qualified pension plan, including those eligible for IMRF.

- Optionally, in Box 14, you can provide additional information regarding IMRF contributions that may clarify for employees.

- Once all sections have been completed, save your changes to the document. You may choose to download, print, or share the updated W-2 form as needed.

Complete your IMRF Tax Letter #17 online today to ensure accurate and timely tax reporting.

IMRF retirement pensions are subject to federal income tax. However, when most members retire, a part of the pension payment they receive represents their own contributions. ... The member does not pay either federal or Illinois income tax on the money used to pay the contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.