Loading

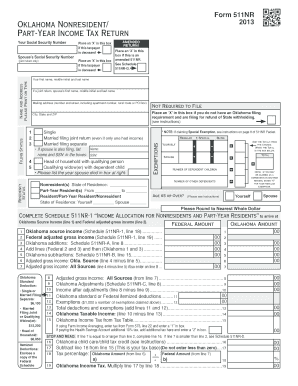

Get Includes Form 511nr (nonresident And Part-year Resident Return) 2013 Oklahoma Individual Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Includes Form 511NR (Nonresident And Part-Year Resident Return) 2013 Oklahoma Individual Income Tax online

Filling out the Includes Form 511NR for the 2013 Oklahoma Individual Income Tax can seem daunting. This guide provides a step-by-step approach to help you complete the form online with confidence, ensuring that you fulfill your tax obligations accurately and efficiently.

Follow the steps to complete your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the top portion of Form 511NR, providing your and your partner's names, Social Security numbers, and mailing address accurately. For joint returns, ensure both names and SSNs are included.

- Select your filing status by checking the appropriate box. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow/widower.

- Indicate residency status by selecting if you are a nonresident, part-year resident, or resident, and ensure this is consistent with the information from your federal return.

- Complete Schedule 511NR-1 to report your federal and Oklahoma source income accurately. Use the amounts from your federal return to populate the appropriate lines.

- Proceed to Schedule 511NR-A to report any additions to your taxable income. This includes items such as state and municipal bond interest or lump-sum distributions.

- Complete Schedule 511NR-B for any applicable subtractions from your taxable income, such as interest on U.S. obligations or military retirement benefits.

- Review and add any adjustments required in Schedule 511NR-C for military pay exclusion or political contributions.

- Calculate your Oklahoma taxable income by finalizing the totals from the above schedules and referring to the tax table to determine your tax amount based on your taxable income.

- Finally, review the entire form for accuracy before submitting. Save your changes, and choose to download, print, or share your form as necessary.

Start filling out your tax return online today to ensure a smooth filing process!

Oklahoma residents are required to file an Oklahoma income tax return when they have enough income that they must file a federal income tax return. Nonresidents are also required to file an Oklahoma income tax return if they have at least $1,000 of income from an Oklahoma employer or other source.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.