Loading

Get Required Minimum Distribution Election Form - Penn Mutual Life

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Required Minimum Distribution Election Form - Penn Mutual Life online

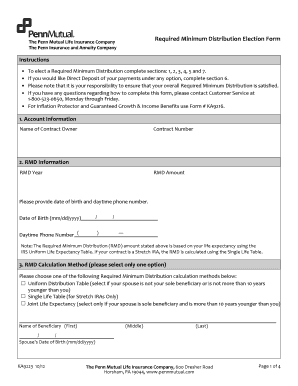

Filling out the Required Minimum Distribution Election Form from Penn Mutual Life can be straightforward with the right guidance. This comprehensive guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete your Required Minimum Distribution Election Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with section 1, where you need to fill in the Account Information, including the name of the contract owner and the contract number.

- Proceed to section 2 to provide your Required Minimum Distribution (RMD) information, including the RMD year, RMD amount, date of birth, and daytime phone number.

- In section 3, select your RMD calculation method. You have three options: the Uniform Distribution Table, Single Life Table (for Stretch IRAs), or Joint Life Expectancy.

- Move to section 4 to choose your RMD Withdrawal Schedule Selection. Select either Option 1 for an automatic withdrawal schedule or Option 2 for a one-time distribution.

- Complete section 5, which involves the W-4P Notice of Federal and State Tax Withholding. Choose whether to withhold taxes from your payments and specify any percentages if applicable.

- In section 6, provide your banking information if you wish to set up direct deposit for your withdrawal payments, including the type of account, account name, routing number, and account number.

- Finalize by signing in section 7. Ensure you indicate the date of your signature as well.

- After completing all the sections, review your form for accuracy before saving changes, downloading, or printing the completed document.

Complete your Required Minimum Distribution Election Form online today for a hassle-free experience.

The SECURE Act of 2019 increased the RMD age from 70½ to 72 years. Now the SECURE 2.0 Act of 2022 is once again delaying the RMD age—from 72 to 73—starting in 2023. And wait, there's more. In 2033, the RMD age will increase to age 75.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.