Loading

Get Fbcretire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fbcretire online

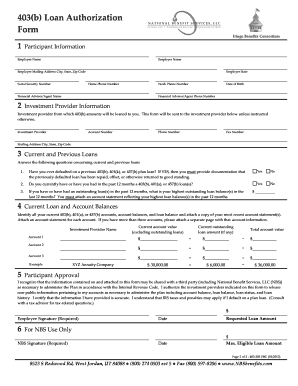

Completing the Fbcretire form is a crucial step for individuals seeking to authorize a loan from their 403(b) account. This guide provides step-by-step instructions to help users efficiently fill out the form online.

Follow the steps to successfully complete the Fbcretire form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your participant information in the first section. This includes your name, employer name, mailing address, Social Security number, phone numbers, and the name of your financial advisor or agent.

- Proceed to the investment provider section. Enter the name of the investment provider from whom you will be borrowing the 403(b) amounts. Include the account number, contact phone and fax numbers, and mailing address.

- In the current and previous loans section, answer the questions regarding any past loan defaults and existing loans. Provide documentation for any defaults, and specify your highest outstanding loan balance in the previous 12 months.

- Identify your current 403(b), 401(a), or 457(b) accounts. List the investment provider name, current account value (excluding loans), and any outstanding loan amounts. Attach the necessary account statements for verification.

- Complete the participant approval section by reviewing the information provided. Ensure you understand that information may be shared with third parties as needed. Provide your signature and the date, indicating your approval of the loan amount requested.

- Finally, enter the requested loan amount and the maximum eligible loan amount. Ensure all information is complete and accurate.

- Once finished, save changes to your form. You can then download, print, or share the completed Fbcretire form as needed.

Take the next steps and complete your documents online today!

The FBC Deferred Compensation Program offers retirement plans for district and charter school employees to put aside money from each paycheck toward retirement. These plans can help bridge the gap between what you will receive in your pension or Social Security, and how much you'll need in retirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.