Loading

Get Page 1 Payroll Processing Service Agreement - Proserve Payroll

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Page 1 Payroll Processing Service Agreement - ProServe Payroll online

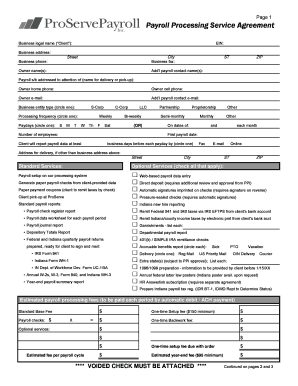

Filling out the Page 1 Payroll Processing Service Agreement for ProServe Payroll is an essential step in ensuring your payroll processes are handled efficiently. This guide will help you navigate the online form, providing clear instructions for each section.

Follow the steps to accurately complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor for online completion.

- Enter the business legal name in the designated field labeled ‘Business legal name (

- Provide your Employer Identification Number (EIN) in the specified section.

- Fill in the business address, including street, city, state (abbreviated), and ZIP code.

- Input the business phone number and fax number as required.

- List the owner's name(s) in the corresponding field.

- Include names for any additional payroll contacts that will be managing payroll processes.

- Indicate who payroll should be addressed to for delivery or pick-up.

- Provide the owner's home phone, cell phone, and email address.

- Complete the section related to business entity type, circling the appropriate option (S-Corp, C-Corp, LLC, Partnership, or Proprietorship).

- Select the payroll processing frequency and payday by circling the relevant options.

- Indicate the number of employees for whom payroll services will be provided.

- Specify the first payroll date and the method by which the client will report payroll data.

- Input the address for delivery, if different from the business address.

- Select the standard and optional services chosen by checking the relevant boxes.

- Enter the estimated payroll processing fees and any applicable setup or backwork fees.

- Ensure that a voided check is attached before final submission.

- Review all the information for accuracy and completeness, then save changes, download, print, or share the completed form as needed.

Complete your Payroll Processing Service Agreement online to streamline your payroll management.

It involves calculating total wage earnings, withholding deductions, filing payroll taxes and delivering payment. These steps can be accomplished manually, but an automated process is usually more accurate and efficient and may help you comply with various payroll regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.