Loading

Get 940-v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 940-V online

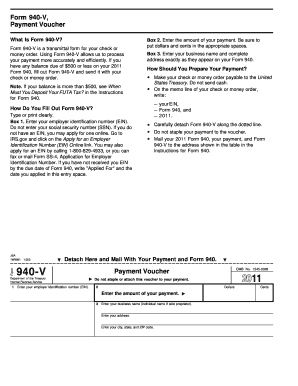

Form 940-V is an important payment voucher used when submitting payments along with your Form 940. This guide will help you navigate the process of filling out Form 940-V online, ensuring your payment is accurately processed.

Follow the steps to fill out Form 940-V online effectively.

- Click ‘Get Form’ button to access the form and open it in the editor.

- In Box 1, enter your employer identification number (EIN). Do not include your social security number (SSN). If you do not have an EIN, apply for one online at the IRS website or by calling 1-800-829-4933.

- In Box 2, input the amount of your payment. Ensure you enter dollars and cents in the correct fields.

- In Box 3, provide your business name and full address exactly as it appears on your Form 940. This is crucial for accurate processing.

- Prepare your payment by making your check or money order payable to the United States Treasury. Avoid sending cash.

- On the memo line of your check or money order, write your EIN, 'Form 940,' and the tax year (2011).

- Carefully detach Form 940-V along the dotted line and do not staple your payment to the voucher.

- Mail your 2011 Form 940, your payment, and Form 940-V to the address provided in the instructions for Form 940.

Complete your documents online today for a smoother filing experience.

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.