Loading

Get Schedule C Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule C Worksheet online

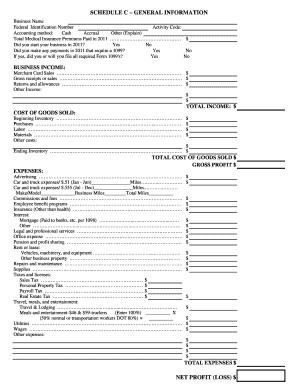

The Schedule C Worksheet is a crucial document for reporting income and expenses from a business. Completing this form accurately is essential for proper tax filing. This guide provides support and clear instructions for filling out the Schedule C Worksheet online, ensuring users can navigate the process with confidence.

Follow the steps to complete your Schedule C Worksheet online.

- Click ‘Get Form’ button to obtain the Schedule C Worksheet and open it for editing.

- Begin by entering your business name in the designated field. Ensure that the name reflects your business as registered with the state.

- Next, input your Federal Identification Number in the appropriate section. This number is essential for tax identification purposes.

- Choose the activity code that best describes your business's primary activity. If you are unsure, refer to the IRS guidelines for activity codes.

- Indicate your accounting method by selecting either cash, accrual, or other. If you choose 'other,' provide an explanation.

- Record the total medical insurance premiums paid during the year in the specified field.

- Respond to the questions regarding whether you started your business during the year and if you made payments that require filing a 1099. Answer accordingly.

- In the Business Income section, fill in your merchant card sales, gross receipts or sales, and any returns and allowances. Sum these amounts for total income.

- Proceed to the Cost of Goods Sold section, entering figures for beginning inventory, purchases, labor, materials, and any other costs. Include your ending inventory to calculate your total cost of goods sold.

- Calculate and record your gross profit by subtracting total cost of goods sold from total income.

- Under the Expenses section, provide detailed amounts for categories such as advertising, vehicle expenses, insurance, and others. Ensure all business-related expenses are documented.

- Sum all expenses to arrive at the total expenses amount.

- Calculate your net profit or loss by subtracting total expenses from gross profit.

- Finally, review the completed Schedule C Worksheet for accuracy. Once satisfied, save your changes, download the form for your records, print, or share it as needed.

Start filling out your Schedule C Worksheet online today to ensure your business reporting is complete and accurate.

Generally, you can't make tax claims without receipts. All of your claimed business expenses on your income tax return need to be supported with original documents, such as receipts. ... All a bank or credit card statement proves is that a payment was made it doesn't verify the nature of the expense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.