Loading

Get Form 89 140

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 89 140 online

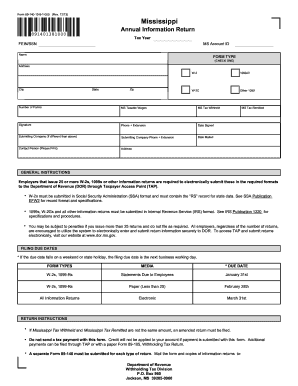

Filling out the Form 89 140 online is a critical step for employers who issue W-2s, 1099s, or other information returns. This guide will provide you with clear instructions on how to accurately complete each section of the form.

Follow the steps to complete the Form 89 140 online.

- Use the ‘Get Form’ button to access and open the form in the online editor.

- Begin by entering the tax year for which you are filing the information return. This is crucial for ensuring that the forms are processed in the correct timeframe.

- Enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN), alongside your Mississippi Account ID. Ensure that these numbers are accurate to avoid processing delays.

- Provide the name of the business or employer as it appears on your tax documents. Be cautious of any typos or spelling errors.

- Fill in the address details, including the street address, city, state, and zip code. This will help the Department of Revenue contact you if necessary.

- Select the form type by checking one of the options: W-2, W-2C, 1099-R, or Other 1099. Ensure that you check the correct box as this affects how your form will be processed.

- Indicate the number of forms being submitted. This section should reflect the total number of W-2s and 1099s issued within the filing year.

- Complete the sections for Mississippi taxable wages and Mississippi tax withheld. Ensure that these figures are accurately calculated to avoid discrepancies.

- Sign the form to validate your submission. It is important that the signature is provided by an authorized person within the organization.

- Fill in your phone number, including the extension, and the date that you are signing the form to provide complete contact information.

- If the submitting company differs from the information given at the top of the form, provide the submitting company’s name and contact information.

- After entering all necessary information, you can save changes, download, print, or share the form as needed to complete your submission.

Get started on completing your Form 89 140 online today for a seamless filing experience.

The due date for filing 2022 Mississippi Individual Income Tax Returns is April 18, 2023. Anyone that requests an extension of time to file has until October 15, 2023 to file the return. Please note that the extension of time is for filing the return, not paying the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.