Loading

Get 3 - Contractor Finalaffidavit.doc. Instructions For Form 706

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3 - CONTRACTOR Finalaffidavit.doc. Instructions For Form 706 online

This guide provides step-by-step instructions for effectively completing the 3 - CONTRACTOR Finalaffidavit.doc. Understanding each component is essential to ensure proper filing. Follow these guidelines to fill out the form accurately and efficiently.

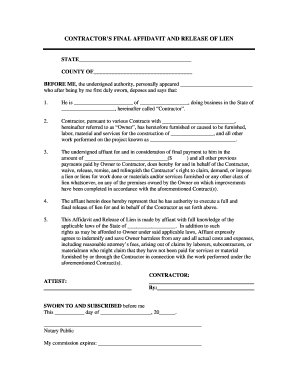

Follow the steps to complete the contractor final affidavit and release of lien.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, fill in the state and county where the affidavit is being executed. This information helps establish jurisdiction and the legal governance of the document.

- In the next field, indicate the name of the person appearing before the notary who will execute the affidavit. This should be the individual representing the contractor.

- Complete the title and business name of the contractor in the corresponding fields. Ensure this matches the business registration information for accuracy.

- Describe the nature of the work performed and the project name. This specification clarifies what the final affidavit pertains to and establishes a clear link to the contractor's work.

- Fill in the amount of final payment received by the contractor from the owner. It is crucial to accurately report the figure to avoid future disputes.

- Acknowledge that the contractor relinquishes their right to claim a lien on the owner’s property related to the completed work. This protects the property owner from future claims.

- Ensure that the affiant can represent the contractor by including relevant authority statements. This validates the affiant's ability to execute the affidavit on behalf of the contractor.

- Complete the section regarding indemnification. This clause protects the owner from claims related to non-payment for services or materials.

- Finally, the contractor must sign the affidavit. The notary public will also sign and date the form, confirming the legal validity of the document.

- Once completed, save the changes to your document. You can then download, print, or share the form as needed.

Complete and file your contractor final affidavit online today to ensure all legal obligations are met.

IRS Form 706 must be filed on behalf of a U.S. citizen or resident whose gross estate, plus adjusted taxable gifts and specific exemptions, exceeds $11,400,000 in 2019 (11,180,000 in 2018), which is also known as the exclusion amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.