Loading

Get File Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the File Tax Forms online

This guide provides you with a step-by-step approach to accurately complete the File Tax Forms online. It is designed to support users of all experience levels, ensuring that you understand each section of the form.

Follow the steps to successfully submit your tax declaration.

- Click ‘Get Form’ button to obtain the form and open it in the editor for completion.

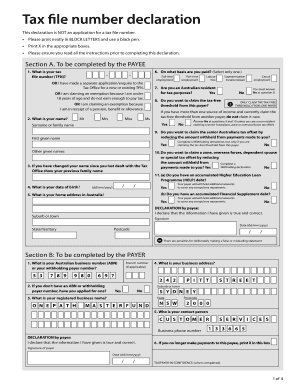

- Begin with Section A, which is to be completed by the payee. Here, you will provide your Tax File Number (TFN) in the first field. If you do not have a TFN, you may indicate that you have applied for one.

- Fill in your personal details, including your name, previous family name (if applicable), date of birth, and home address in Australia. Ensure to print neatly in block letters.

- Indicate whether you are an Australian resident for tax purposes by selecting 'Yes' or 'No' on the appropriate line.

- Select your basis of payment from the options provided (e.g., Full-time employment, Part-time employment).

- Address whether you wish to claim the tax-free threshold from this payer. Only select 'Yes' if you have not claimed it from another payer.

- Continue with questions regarding the senior Australians tax offset, Higher Education Loan Programme debt, and any accumulated Financial Supplement debt. Answer 'Yes' or 'No' as applicable.

- Review all the entered information to ensure accuracy. Make sure all questions have been answered appropriately.

- Sign and date the declaration at the bottom of Section A, confirming that the information provided is true and correct.

- Once completed, save your changes, and you may choose to download, print, or share the form according to your requirements.

Take the next step and fill out your tax forms online today.

Free File Fillable Forms is the only IRS Free File option available for taxpayers whose income (AGI) is greater than $72,000. Taxpayers whose income is $72,000 or less qualify for IRS Free File partner offers, which can guide you through the preparation and filing of your tax return, and may include state tax filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.