Loading

Get 2005-12 Ira Transfer Form.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2005-12 IRA Transfer Form.doc online

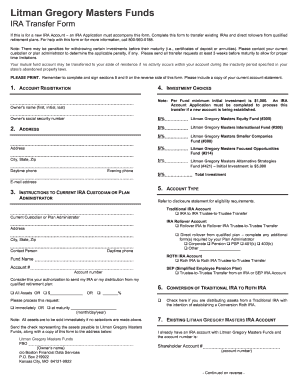

Filling out the 2005-12 IRA Transfer Form online is a straightforward process that allows users to transfer existing IRAs or direct rollovers efficiently. This guide will walk you through the necessary steps to complete the form accurately and confidently.

Follow the steps to fill out the IRA transfer form online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editing platform.

- Begin with the 'Account Registration' section. Enter the owner's name (first, initial, last) and social security number.

- Proceed to the 'Address' section. Fill in the complete address, including city, state, and zip code, along with daytime and evening phone numbers.

- In the 'Investment Choices' section, select your desired funds and specify the amount or percentage to be allocated to each fund. Ensure to note the minimum investment requirements.

- Complete the 'Instructions to Current IRA Custodian or Plan Administrator' section. Enter the current custodian's or plan administrator's name and address.

- Indicate the account type you are transferring, filling in the relevant details as per your situation (Traditional IRA, Rollover IRA, Roth IRA, etc.).

- Fill out the 'Conversion of Traditional IRA to Roth IRA' if applicable, noting the percentage plans you wish to convert.

- Detail your existing Litman Gregory Masters IRA account number if you already have one.

- Complete the 'Age 70 1/2 Information' section based on your age and ensure necessary compliance regarding required minimum distributions.

- Sign the 'Acceptance by New Custodian' section, ensuring you acknowledge the responsibilities involved.

- Finally, sign and date the form in the designated 'Signature of Depositor' section. Complete the signature guarantee if required.

- Once you have filled out all sections, save your changes, and consider downloading or printing the completed form. You may also share it with relevant parties as necessary.

Start completing your IRA transfer form online today for a smooth transition!

Like all retirement plans or IRA distributions, rollover distributions are reported to the taxpayer on the Form 1099-R.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.