Loading

Get Wtcap Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wtcap Form online

Filling out the Wtcap Form online can be straightforward with the right guidance. This guide will walk you through each step of the process, ensuring that you can complete your form accurately and efficiently.

Follow the steps to fill out the Wtcap Form online

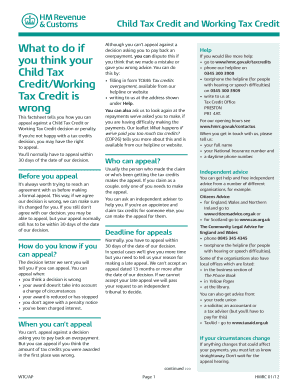

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your personal details in the ‘About You’ section. Provide your full name, title, address, and daytime phone number. Additionally, input your National Insurance number and date of birth.

- Answer the question regarding whether you have a representative assisting you. If yes, fill out their name and address accordingly.

- Indicate the date of the decision you are appealing against in the specified format (DD MM YYYY). This date is found on the decision letter you received.

- In the appeal section, detail why you disagree with the decision. Be specific about the information you believe is incorrect, and if applicable, list any additional decisions you are appealing.

- Ensure you sign the form to authorize any representative acting on your behalf. If someone is appointed, they should sign for you.

- Review the completed form for any errors, and then save your changes. You can choose to download, print, or share the form with the appropriate contacts.

Complete your Wtcap Form online today for a seamless filing experience.

Excess Advance Child Tax Credit Payment Amount: If your advance Child Tax Credit payments exceeded the amount of Child Tax Credit you can properly claim on your 2021 tax return, you may need to repay to the IRS some or all of that excess payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.