Loading

Get Elevation Difference Worksheet - Fidelity Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ELEVATION DIFFERENCE WORKSHEET - Fidelity Online

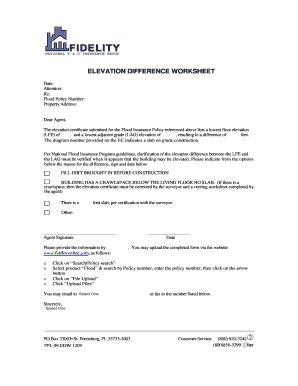

The elevation difference worksheet is a crucial document required for verifying the elevation difference related to flood policies. This guide will walk you through the steps needed to complete the ELEVATION DIFFERENCE WORKSHEET efficiently and accurately online.

Follow the steps to fill out the ELEVATION DIFFERENCE WORKSHEET correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the date at the top of the worksheet. Ensure the date is accurate to avoid any processing issues.

- Enter the attention line, indicating whom the document is directed toward. This could be the name of the individual or department handling the flood policy.

- In the 'Re' section, reference the purpose of the document succinctly, ensuring it relates clearly to the flood policy.

- Input the flood policy number, which is crucial for identifying the specific policy that the worksheet pertains to.

- Provide the property address where the flood policy applies. Verify that the address entered matches official records.

- In the body of the document, fill in the lowest floor elevation (LFE) and the lowest adjacent grade (LAG) elevation. These values determine the elevation difference, which is then calculated automatically.

- Select the appropriate reason for the elevation difference from the options provided. If applicable, specify if there is a crawlspace or slab involved, and provide a measurement if there is a slab.

- Sign and date the document in the designated area to validate the information presented.

- After completing the form, save your changes, and consider downloading or printing a copy for your records.

- Upload the completed worksheet via the methods outlined, either by using the upload feature on the website or by emailing or faxing the document to the designated contacts.

Start filling out your ELEVATION DIFFERENCE WORKSHEET online today to ensure compliance with flood insurance requirements.

Internal Revenue Code section 72(t) allows penalty-free1 access to assets in IRAs and employer-sponsored retirement plans under certain conditions, such as account holder death or disability, first-time home purchases, and taking substantially equal periodic payments (SEPP).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.