Loading

Get American Heart Association Form W 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the American Heart Association Form W 9 online

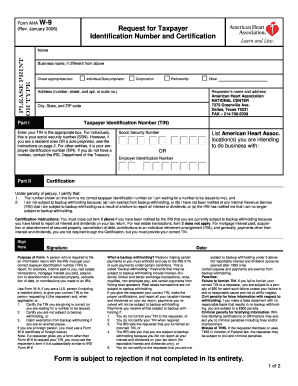

Completing the American Heart Association Form W 9 online is an essential step for individuals and entities intending to provide taxpayer identification information. This guide will walk you through each section of the form, ensuring clarity and accuracy.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter your name and business name if it differs from your personal name.

- Select the appropriate box that describes your business status: Individual/Sole proprietor, Partnership, or Other.

- Fill in the requester’s name and address, which will be the American Heart Association's details located in Dallas, Texas.

- Provide your address, including street, apartment or suite number, city, state, and ZIP code.

- In Part I, input your Taxpayer Identification Number (TIN). For individuals, this is your social security number; for entities, it is your employer identification number.

- In Part II, if applicable, check the box for Corporation and provide the corresponding Employer Identification Number (EIN). You may also list American Heart Association locations you intend to do business with.

- Carefully read and complete the certification statement, ensuring all statements are accurate.

- Sign and date the form at the designated section to affirm that the information provided is correct.

- After completing the form, you can save changes, download, print, or share the document as needed.

Complete your form online now to ensure timely processing.

IRS Form W-9 is most commonly used by individuals when they are working as a freelancer or independent contractor. If you ever find yourself filling out a Form W-9, it generally means that a business or person who is paying you money needs your Social Security number so it can notify the IRS of the amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.