Loading

Get Mortgage Application Form (blank) - Legacy Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mortgage Application Form (Blank) - Legacy Mortgage online

Filling out the Mortgage Application Form can seem daunting, but this comprehensive guide will provide you with clear, step-by-step instructions to help you complete the form with confidence. Follow these steps to ensure that your application process is smooth and efficient.

Follow the steps to successfully complete the Mortgage Application Form online

- Click the 'Get Form' button to obtain the Mortgage Application Form (Blank) - Legacy Mortgage and open it in your preferred online editor.

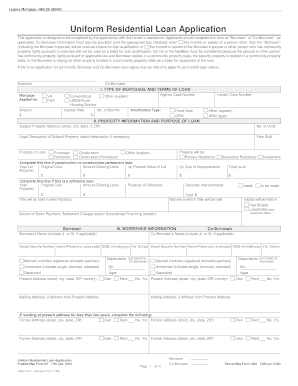

- Begin filling in your personal information in the 'Borrower' and 'Co-Borrower' sections. This includes names, Social Security numbers, home phone numbers, and dates of birth.

- In the 'Type of Mortgage and Terms of Loan' section, select the mortgage type you are applying for, such as VA, FHA, or Conventional, and enter the amount you wish to borrow along with the interest rate.

- Complete the 'Property Information and Purpose of Loan' section by providing details about the property address, the number of units, and the purpose of the loan, whether it's for purchase or refinance.

- In the 'Borrower Information' section, detail your employment information, including your job title, employer's address, and years employed. If applicable, include the same information for the Co-Borrower.

- Provide your monthly income details in the 'Monthly Income and Combined Housing Expense Information' section. Include your base employment income, overtime, bonuses, and any other sources of income.

- In the 'Assets and Liabilities' section, list your assets, such as cash deposits or real estate owned, and detail any outstanding debts or liabilities.

- Fill out the 'Details of Transaction' and 'Declarations' sections, answering all questions honestly to avoid misrepresentation on your loan application.

- Complete the 'Acknowledgment and Agreement' section by reviewing the terms and conditions of the application. Ensure all information is accurate and ready for review.

- Finally, save your changes, download the completed form, and print it if necessary. You can also share the form electronically, as required.

Complete your mortgage application online today to make the process easier and faster.

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.