Loading

Get Anti-steering Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Anti-Steering Form online

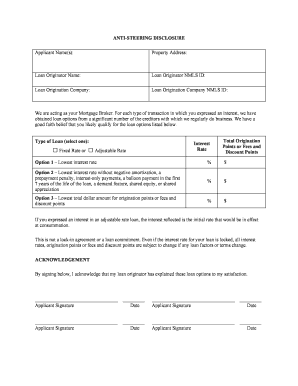

Filling out the Anti-Steering Form online is a crucial step in your mortgage application process. This guide provides clear and detailed instructions to help you complete the form accurately.

Follow the steps to fill out the Anti-Steering Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the applicant name(s) in the designated field. Ensure that all names are spelled correctly as they appear on legal documents.

- Next, fill in the property address where the loan will be applied. This includes the street address, city, state, and zip code.

- In the following fields, provide the name of your loan originator. It is essential for this information to match their identification documents.

- Enter the loan originator's NMLS ID, which is a unique identification number assigned to them.

- Input the name of the loan origination company. Double-check to ensure the name is correct to avoid any processing delays.

- Provide the NMLS ID for the loan origination company as well.

- Select the type of loan you are interested in by marking the corresponding box for either fixed rate or adjustable rate.

- For the total origination points or fees and discount points, clearly input the percentage and dollar amount for the chosen loan options presented.

- Review all the information you have entered to ensure completeness and accuracy. Misentries can delay the processing of your mortgage application.

- By signing this form, you acknowledge that the loan originator has explained the loan options to your satisfaction. Sign and date the form in the designated areas.

- After completing the form, you can save your changes, download, print, or share the form as necessary.

Complete your Anti-Steering Form online today to streamline your mortgage application process.

The Anti-Steering Disclosure must: Indicate the types of transactions the consumer is interested in; Clearly indicate the options presented for each type of transaction the consumer is interested in; Indicate the option selected by the consumer; and Be signed and dated by the Loan Originator and the consumer(s).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.