Loading

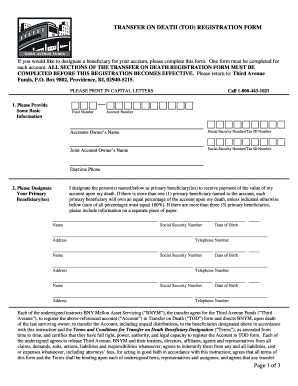

Get Page 1 Of 3 Transfer On Death (tod) Registration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Page 1 Of 3 Transfer On Death (Tod) Registration Form online

Filling out the Page 1 Of 3 Transfer On Death (TOD) Registration Form online is a straightforward process that helps individuals designate beneficiaries for their accounts. This guide offers detailed instructions to ensure each section is completed accurately and effectively.

Follow the steps to fill out the form correctly online.

- Press the ‘Get Form’ button to access the form digitally and open it for editing.

- Provide some basic information by filling in the fund number, account number, account owner’s name, social security number or tax ID number, joint account owner’s name, social security number or tax ID number, and daytime phone.

- Designate your primary beneficiary or beneficiaries by listing their names, social security numbers, dates of birth, addresses, and telephone numbers. Ensure that if there are multiple beneficiaries, the percentage of the account ownership is specified, totaling 100%.

- Ensure you understand and agree to the instructions outlined for registering the account in a Transfer on Death form, which includes consent for the transfer to beneficiaries.

- Provide signatures of both the account owner and joint account owner, including the date. If required, obtain a notarization or a Medallion Signature Guarantee.

- Review all entries for accuracy and completeness, ensuring that every section has been filled out correctly.

- Save your changes, then download, print, or share the filled-out form as necessary.

Complete your documents online with ease and confidence.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.