Loading

Get Citi Mortgage Application.pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Citi Mortgage Application.pdf online

Filling out the Citi Mortgage Application.pdf is an essential step in securing a mortgage loan. This guide will provide clear instructions on how to complete the form online, ensuring you have all the necessary information to streamline the process.

Follow the steps to effectively complete your Citi Mortgage Application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

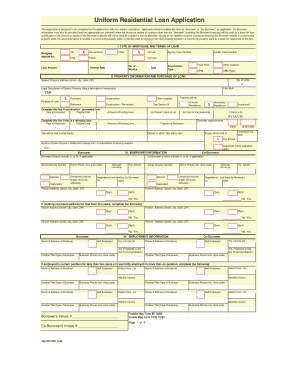

- Start by identifying the type of mortgage and terms of the loan. Provide details such as the mortgage type (VA, FHA, Conventional, etc.) and the loan amount you are applying for.

- Next, fill in the property information and the purpose of the loan. Include the subject property address, the year built, and select whether the loan is for purchase, construction, refinance, or another purpose.

- Complete the borrower information section. This includes entering the names, social security numbers, and contact details for both the borrower and co-borrower, if applicable. Ensure to record any dependents.

- Proceed to fill in the employment information. Indicate your current employer's name and address, your position, and the years of employment. If employed for less than two years, provide details for any prior job.

- In the monthly income section, report your gross monthly income sources. Be comprehensive, including salary, overtime, bonuses, and any other income types.

- Detail your assets and liabilities. List all bank accounts, outstanding debts, and any valuable assets you may have. This helps in assessing your financial position.

- Provide details of the transaction, including the purchase price and estimated closing costs. Respond carefully to any declaration questions regarding your financial history and current obligations.

- Complete the government monitoring information. This section is crucial if the loan relates to a dwelling, and you can choose whether to provide demographic details.

- Finally, review the acknowledgment and agreement section. Ensure that all information is accurate and sign the document. Your signatures indicate your commitment to the terms of the loan.

- Once completed, save your changes. You can download, print, or share the form as needed.

Start filling out your Citi Mortgage Application online today!

Citibank may approve you for a personal loan in as fast as the same day you apply. After your application is approved and you accept the offer, it takes 1 - 5 business days to receive your funds, which Citibank will send to you by electronic bank transfer or check.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.