Loading

Get Completing Parts I And Ii Of Annual Tax And Wage Report ... - Dol State Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the completing parts I and II of annual tax and wage report for domestic employment online

Filling out the annual tax and wage report is essential for domestic employers to ensure compliance with tax regulations. This guide provides a clear and supportive walkthrough for completing Parts I and II of the form online.

Follow the steps to accurately complete your annual tax and wage report.

- Press the ‘Get Form’ button to obtain the form and open it in an appropriate editing tool.

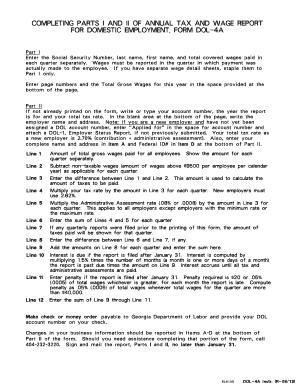

- In Part I, enter the Social Security Number, last name, first name, and total covered wages paid for each quarter separately. Ensure that wages are reported in the quarter when payment was made to the employee. If you have separate wage detail sheets, staple them only to Part I.

- Enter the page numbers and the total gross wages for the year in the designated area at the bottom of the page.

- In Part II, if not printed, write or type your account number, the report year, and your total tax rate. In the space at the bottom, provide your employer name and address. New employers should enter 'Applied for' if an account number has not been assigned and attach a DOL-1 form if not previously submitted.

- Complete Item A with your full name and address, and enter your Federal ID number in Item D at the bottom of Part II.

- In Line 1, state the total gross wages paid for all employees for each quarter separately.

- In Line 2, subtract any non-taxable wages that exceed $9,500 per employee for the calendar year for each quarter.

- In Line 3, calculate the difference between Line 1 and Line 2; this amount will be used to determine the taxes owed.

- Multiply your tax rate by the amount in Line 3 for each quarter to calculate your contribution tax due. New employers must use a rate of 2.62%.

- In Line 5, calculate the Administrative Assessment by multiplying the rate (0.08% or 0.0008) by the amount in Line 3 for each quarter, applicable to all employers except those with the minimum or maximum rate.

- Add the amounts in Lines 4 and 5 for each quarter and enter the total in Line 6.

- If previous quarterly reports were filed, indicate the taxes paid for that quarter in Line 7.

- Calculate the difference between Line 6 and Line 7, if applicable, and enter it in Line 8.

- If the report is submitted after January 31, calculate interest by multiplying 1.5% by the number of months overdue multiplied by the amount in Line 9.

- Determine any penalties due for late submission, which could be $20 or 0.05% of total wages each month overdue, and enter in Line 11.

- Sum the totals from Line 9 through Line 11 for the total amount due in Line 12.

- Sign and date the report, then mail Parts I and II together with a check payable to the Georgia Department of Labor.

Complete and submit your annual tax and wage report online to ensure compliance and avoid penalties.

Information for tax year 2022 is now available. Unemployment compensation is taxable income and must be reported each year even if you have repaid some or all of the benefits received.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.