Loading

Get T3012a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T3012a form online

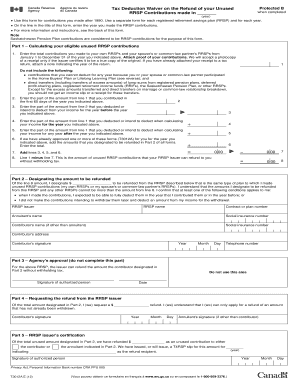

The T3012a form is essential for individuals seeking to authorize their registered retirement savings plan issuer to refund unused RRSP contributions without incurring withholding tax. This guide provides a step-by-step approach to filling out the form online, ensuring a clear understanding of each component.

Follow the steps to complete the T3012a form online effectively.

- Click the ‘Get Form’ button to access the T3012a form and open it in your preferred editor.

- In the title section of the form, enter the year during which you made your unused RRSP contributions. Ensure you obtain separate forms for each RRSP and for each year.

- Part 1 requires you to enter the total contributions made to your RRSPs and your partner's RRSPs for the specified year. Attach proof of these contributions, which can be a certified photocopy of your receipt.

- Exclude any contributions that were not deductible due to participation in the Home Buyers' Plan or the Lifelong Learning Plan. Also, do not include direct transfers from other savings plans.

- Continue by filling in the specific amounts for the first 60 days of the year, amounts deducted from your income for previous years, and amounts intended for future deductions, as required in the relevant fields.

- In Part 2, designate the amount you would like refunded, ensuring it does not exceed the total from the prior calculations. Confirm that the necessary conditions are met regarding your contributions.

- Complete the remaining parts of the form, including signatures and relevant information needed for processing by your RRSP issuer.

- Once all the information is completed, save your changes, download and print a copy or share it electronically with the appropriate parties to submit.

Get started on filling out the T3012a form online today to ensure you complete your tax documentation accurately and efficiently.

The RRSP withdrawal age is 71 years. You are not allowed to own an RRSP past December 31 of the calendar year you turn the age of 71. The funds must be withdrawn, or the account converted to an RRIF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.