Loading

Get Standard Flood Hazard Determination Form 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Standard Flood Hazard Determination Form 2020 online

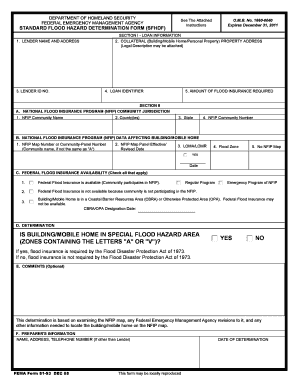

The Standard Flood Hazard Determination Form 2020 is a critical document that assesses flood hazard risks for properties. Completing this form accurately is essential for compliance with federal requirements regarding flood insurance.

Follow the steps to fill out the Standard Flood Hazard Determination Form 2020 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the lender name and address in Section I, which identifies the party responsible for the loan.

- Provide the collateral property address for the building, mobile home, or personal property securing the loan. If needed, attach a legal description of the property.

- Fill in the lender identification number, ensuring to use the correct number based on the lender type (e.g., FDIC-insured).

- Optionally, enter a loan identifier for internal tracking.

- Specify the amount of flood insurance required, adhering to federal minimums and lender policies.

- In Section II, identify the community jurisdiction by providing the NFIP Community Name, county, state, and NFIP community number.

- Gather NFIP data affecting the building or mobile home, including the community-panel number, map date, LOMA/LOMR information, and flood zones.

- Check the federal flood insurance availability options that apply to the property — indicating regular or emergency program participation.

- Complete the determination section, indicating whether the property is in a Special Flood Hazard Area and if flood insurance is required.

- Optionally include comments regarding the determination or other relevant information.

- If applicable, provide the preparer's information, including name, address, and telephone number.

- Finalize the form by entering the date of determination, ensuring all information is complete.

- Users can save changes, download, print, or share the form as needed.

Complete your Standard Flood Hazard Determination Form online today to ensure compliance with flood insurance requirements.

Related links form

If the borrower/unit owner or the condominium association fails to purchase flood insurance sufficient to meet the regulation's mandatory requirements within 45 days of the lender's notification to the individual unit owner/borrower of inadequate insurance coverage, the lender must force place the necessary flood ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.