Loading

Get Ca Southern District Chapter 7 Bankruptcy; How To Type Creditor Matrix Pro Se Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Southern District Chapter 7 Bankruptcy; How To Type Creditor Matrix Pro Se Form online

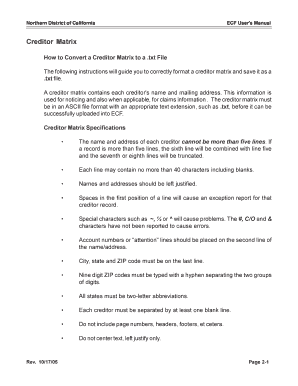

Filing a Chapter 7 bankruptcy can be a complex process, but understanding how to properly complete the Creditor Matrix Pro Se Form is crucial. This guide will provide you with clear, step-by-step instructions to help you fill out the form correctly and efficiently.

Follow the steps to complete the creditor matrix form effectively.

- Click the ‘Get Form’ button to access the creditor matrix form.

- Begin by entering the name of the first creditor. Ensure the name is left justified and does not exceed 40 characters, including spaces.

- Enter the complete mailing address of the creditor on the next line, ensuring to include the city, state, and ZIP code on the final line.

- If applicable, place any account numbers or 'attention' lines on the line following the creditor’s name. Ensure lines do not exceed the five-line limit per creditor.

- Separate each creditor's information with at least one blank line to maintain proper formatting.

- Avoid using special characters that could cause errors. Only include characters such as #, C/O, and & where necessary.

- Review the entire matrix for alignment, ensuring all text is left justified and that there are no extra spaces at the beginning of lines.

- Save your completed matrix in ASCII format. Make sure to name the file appropriately before saving it with the .txt extension.

- After saving, verify the formatting by using any available review program to check for errors before uploading.

Complete your documents online to facilitate your bankruptcy filing process.

2. Review Your Credit Reports. Your credit reports are the first place you should look for your debts, so be sure to get your free annual credit reports. Most loan accounts (such as credit cards, auto loans, student loans) are reported to the three major credit reporting agencies: Equifax, Experian and TransUnion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.