Loading

Get Usalliance Overdraft Protection Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Usalliance Overdraft Protection Form online

Filling out the Usalliance Overdraft Protection Form online can be a straightforward process. This guide will provide step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Usalliance Overdraft Protection Form online.

- Press the ‘Get Form’ button to access the document and open it in your online editor.

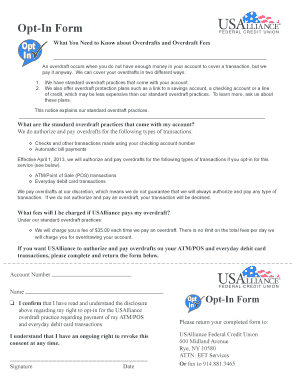

- Locate the section that requires your account number. Enter your account number accurately to ensure the form is processed correctly.

- In the next field, provide your full name. Ensure that you use the name as it appears on your account.

- Read the disclosure regarding your right to opt-in for overdraft protection carefully. Confirm your understanding by checking the box that states your acknowledgment.

- Sign the form in the designated signature line. Make sure your signature matches the one on file with Usalliance.

- Enter the current date in the provided field to indicate when you are submitting the form.

- After completing the form, make sure to review all entries for accuracy. Once verified, you can save your changes, download a copy, print, or share the form as needed.

Complete your Usalliance Overdraft Protection Form online today to ensure your account is protected.

If you opt for overdraft protection and link a USAA credit card or another checking or savings account, USAA will transfer money to cover your overdraft in $100 increments for free. Otherwise, you can expect an overdraft fee or non-sufficient funds fee of $29.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.